Title: Navigating the Secular Bull Market: Strategies for Success Amid Major Rotation

Introduction:

In today’s dynamic financial landscape, investors are witnessing a fascinating phenomenon – the continuation of a secular bull market marked by significant sector rotation. As the global economy rebounds from the challenges of the past years, staying informed and adopting strategic approaches are essential for investors to thrive in this evolving market environment.

Understanding the Secular Bull Market:

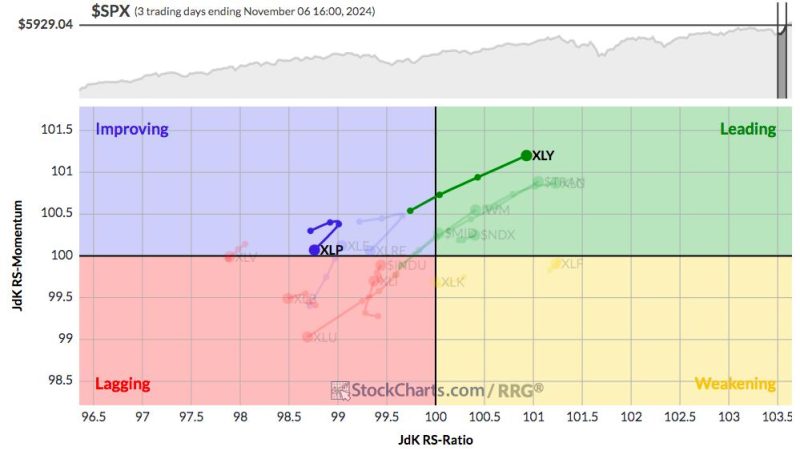

The article by Godzilla Newz explores the concept of a secular bull market, characterized by prolonged periods of rising asset prices driven by improving economic conditions. However, what sets the current market apart is the major rotation taking place within sectors, reshaping investment opportunities and risk profiles for market participants.

Implications of Sector Rotation:

The shift in sector leadership within the secular bull market introduces both opportunities and challenges for investors. While some sectors experience explosive growth, others may lag behind, requiring a discerning approach to portfolio management and asset allocation. Adapting to changing market dynamics is crucial to capitalize on emerging trends and safeguard against potential risks.

Strategies for Success:

1. Diversification: Emphasize diversification across sectors and asset classes to mitigate risks associated with sector rotation. A well-balanced portfolio can help weather market fluctuations and capture opportunities across various sectors.

2. Research and Due Diligence: Stay informed about market trends, economic indicators, and sector-specific developments. Conduct thorough research and due diligence before making investment decisions to ensure alignment with your financial goals and risk tolerance.

3. Active Management: Consider adopting an active management approach to capitalize on sector rotation trends. Regularly review and adjust your portfolio to take advantage of emerging opportunities and reduce exposure to underperforming sectors.

4. Risk Management: Implement risk management strategies, such as stop-loss orders and hedging techniques, to protect your portfolio against sudden market shifts. Maintaining a disciplined approach to risk management can help preserve capital during periods of heightened volatility.

Conclusion:

As the secular bull market continues with major sector rotation, investors must adapt and refine their strategies to navigate the evolving market landscape successfully. By emphasizing diversification, conducting thorough research, practicing active management, and implementing effective risk management measures, investors can position themselves for long-term success amid changing market conditions. Stay informed, stay agile, and stay focused on your financial objectives to seize the opportunities presented by this dynamic market environment.