Title: Maximizing Profits During an Election Rally: Strategies for Success

Introduction:

As political seasons gear up and election rallies gain momentum, investors often wonder how best to capitalize on the financial opportunities presented by these events. While the stock market can experience increased volatility during election periods, astute investors can position themselves strategically for potential profits. In this article, we will explore some insightful strategies to help you make the most of an election rally.

Understanding Market Behavior During Election Rallies:

Election rallies are marked by heightened political fervor, speculation, and uncertainty. This can lead to increased market volatility as investors react to changing expectations and political developments. Historically, markets have shown a tendency to rally in the lead-up to elections, driven by optimism over potential policy changes and their expected impact on various sectors.

Key Strategies for Capitalizing on Election Rallies:

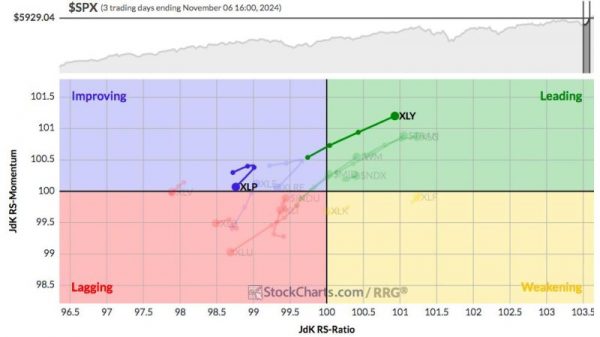

1. Sector Rotation: During an election rally, certain sectors may outperform others based on the prevailing political narrative. By identifying sectors likely to benefit from a particular candidate’s policies, investors can strategically rotate their assets to take advantage of the anticipated market trends.

2. Quality Stocks: Investing in quality stocks with strong fundamentals and proven track records can provide stability and resilience during turbulent market conditions. Look for companies with solid financials, competitive advantages, and sound management teams to weather potential market fluctuations.

3. Options Trading: Options trading can offer a flexible and cost-effective way to profit from market movements during election rallies. By using options strategies like straddles, strangles, or covered calls, investors can position themselves to benefit from both bullish and bearish scenarios in the market.

4. Risk Management: Managing risk is crucial when navigating the uncertainties of an election rally. Diversifying your portfolio, setting stop-loss orders, and maintaining a long-term perspective can help protect your investments from sudden market swings and unexpected events.

5. Market Sentiment Analysis: Keeping a close eye on market sentiment and political developments can provide valuable insights into investor behavior and potential market trends. By staying informed and adapting your investment strategy accordingly, you can make informed decisions during an election rally.

Conclusion:

Election rallies present unique opportunities for investors to capitalize on market volatility and political dynamics. By implementing the strategies outlined in this article, you can position yourself for success and maximize your profits during these pivotal periods. Remember to conduct thorough research, stay disciplined in your approach, and seek advice from financial professionals to make the most of an election rally. Happy investing!