Title: Must-See Updates to RRG Charts on StockCharts

Introduction:

Investing in the stock market requires careful analysis and up-to-date information to make informed decisions. One valuable tool that investors can utilize is the Relative Rotation Graph (RRG) charts on StockCharts. These charts provide a visual representation of the relative strength and momentum of various assets or stocks compared to a benchmark index. In this article, we will explore the recent updates and enhancements made to RRG charts, making them a must-see for investors seeking to improve their portfolio management strategies.

1. Understanding RRG Charts:

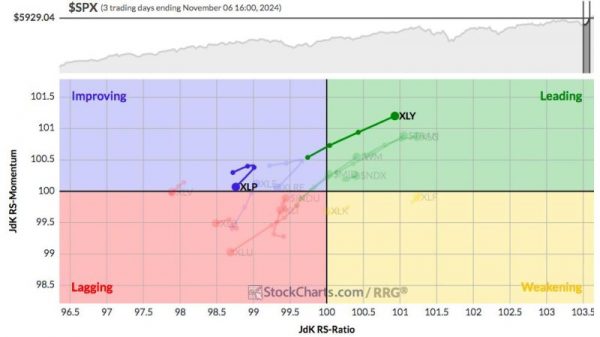

Before delving into the updates, it’s essential to understand how RRG charts work. RRG charts plot the price movements of different assets or stocks against a benchmark index, such as the S&P 500. The four quadrants on the chart represent the relative strength and momentum of each asset. Assets in the leading quadrant are outperforming both the benchmark and other assets, while those in the lagging quadrant are underperforming.

2. Enhancements to RRG Charts:

StockCharts has introduced several enhancements to RRG charts to provide investors with more insights and customization options. One significant update is the ability to customize the benchmark index to suit specific investment strategies. This feature allows investors to compare assets against a relevant index, enhancing the accuracy of their analysis.

3. Expanded Timeframes:

Another useful update is the inclusion of expanded timeframes on RRG charts. Investors can now analyze the relative strength and momentum of assets over multiple timeframes, ranging from short-term to long-term perspectives. This feature enables investors to spot emerging trends and make more informed decisions based on historical performance data.

4. Improved Visualization Tools:

StockCharts has also added new visualization tools to RRG charts, making it easier for investors to interpret the data and identify potential investment opportunities. The addition of custom color schemes, trendlines, and annotations enhances the clarity and usability of the charts, helping investors track the performance of assets more effectively.

5. Integration with Technical Analysis:

By integrating RRG charts with technical analysis indicators, investors can gain a more comprehensive understanding of market dynamics and potential price movements. StockCharts offers a wide range of technical indicators that can be overlaid on RRG charts, providing additional insights into market trends and momentum.

Conclusion:

In conclusion, the recent updates to RRG charts on StockCharts have made them a valuable tool for investors looking to enhance their portfolio management strategies. By offering customizable benchmarks, expanded timeframes, improved visualization tools, and integration with technical analysis, RRG charts provide investors with a powerful tool to identify trends, make informed decisions, and optimize their investment portfolios. Whether you are a seasoned investor or new to the stock market, exploring RRG charts can help you gain a competitive edge and achieve better investment outcomes.