Title: China’s Stimulus Efforts Boost FXI Position in the Market

Introduction:

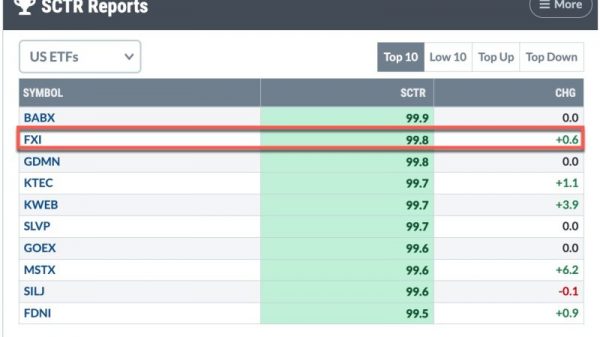

In the wake of global economic challenges, China’s recent stimulus efforts have had a significant impact on the financial markets, with the iShares China Large-Cap ETF (FXI) rising to second position as a preferred investment choice. This article explores the implications of China’s stimulus measures on the FXI’s market performance, shedding light on emerging investment trends and potential opportunities for investors.

China’s Economic Stimulus and Market Response:

China, as a major global economic player, has responded to recent economic headwinds with a series of stimulus measures aimed at boosting growth and stabilizing key sectors. From infrastructure investments to monetary policy adjustments, China’s proactive approach has resonated positively in the financial markets. The injection of liquidity and support for industries have bolstered investor confidence and contributed to the rise of the FXI in market rankings.

FXI’s Ascendance in Market Ranking:

The iShares China Large-Cap ETF (FXI) has climbed the ranks in the market, reflecting investor interest in Chinese equities following the country’s stimulus initiatives. FXI, with its focus on large-cap Chinese companies, has become an appealing investment option for those seeking exposure to China’s dynamic market landscape. The ETF’s performance and positioning point to a growing recognition of China’s resilience and potential for long-term growth.

Investment Implications and Opportunities:

For investors looking to capitalize on China’s stimulus-driven market dynamics, allocating resources to ETFs like FXI may present an attractive opportunity. With a diversified portfolio of Chinese blue-chip stocks, FXI offers exposure to sectors benefiting from government support and economic stimuli. As China continues to navigate economic challenges, strategic investments in FXI and related instruments could yield favorable returns for savvy investors.

Conclusion:

China’s strategic stimulus efforts have reverberated through the financial markets, propelling the FXI to a prominent position as an investment vehicle of choice. The ETF’s performance reflects growing investor confidence in China’s resilience and growth potential, underscoring the allure of Chinese equities in a turbulent global economic landscape. By understanding and leveraging opportunities presented by China’s economic stimuli, investors can position themselves advantageously for potential long-term gains in the ever-evolving market environment.